Natural gas prices see-sawed Tuesday as traders weighed modest near-term domestic heating needs against an anticipated freeze early next month and surging demand for U.S. liquefied natural gas (LNG). Ultimately, the latter factors carried the day, and the January Nymex gas futures contract advanced 3.5 cents and settled at $3.869. February gained 1.6 cents to $3.774.

At A Glance:

- U.S. exports of LNG hold strong

- Weather picture to brighten early in 2022

- Northeast demand bolsters cash prices

NGI’s Spot Gas National Avg. rose 13.5 cents to $4.750 on Tuesday, bolstered by advances in the Northeast.

The prompt month had rallied on Monday as well, gaining 14.4 cents on record levels of demand for U.S. exports early this week. NGI estimates showed that LNG feed gas volumes reached a new high of 13.1 Bcf/d on Sunday and held near that level on Monday and Tuesday.

Much of Europe is potentially short on natural gas in storage just as deep freezes are settling in across the continent. With anticipated flows from Russia yet to mount because of regulatory delays and political strife, several European countries are increasingly calling for U.S. exports, driving the lofty LNG demand. Demand from Asia is also robust.

At the same time, U.S. production has tapered in recent days, falling below 96 Bcf on Monday and remaining below that level on Tuesday, according to Bloomberg estimates. Output had topped 97 Bcf in November and held close to that level heading into December.

EBW Analytics Group senior analyst Eli Rubin said production could remain relatively light moving into early 2022. “January tends to be a difficult month for dry gas supply to increase as colder weather often yields production freeze-offs,” Rubin said.

He said production has fallen in January in four out of five years for an average monthly loss of 0.72 Bcf/d. “This year, pipeline scrapes indicate that dry gas output is already sliding from early-winter highs,” he said.

While weather patterns through this week are not expected to drive widespread heating needs, the demand picture could brighten in early January, NatGasWeather said.

Both the American and European weather models trended warmer overnight into Tuesday, showing milder conditions over northern portions of the country for this weekend and into next week, the firm said. However, the models “both continue to forecast a rather chilly U.S. pattern Jan. 1-5.”

There “will continue to be bouts of cold air across the West and northern Plains the rest of the month,” but they are not expected to advance “aggressively south or eastward,” NatGasWeather added. That noted, “cold air over the northern Plains is still expected to spread across the rest of the Midwest Jan 1-5, as well as down the Plains and across the Northeast.”

Storage Snapshot

Looking ahead to Thursday’s U.S. Energy Information Administration (EIA) storage report for the period ended Dec. 17, NGI’s model predicted a pull of 53 Bcf. A year earlier, utilities withdrew 147 Bcf from storage, while the five-year average is a 153 Bcf reduction in supplies.

An estimate from Energy Aspects pointed to a 59 Bcf withdrawal for the upcoming report.

The firm modeled a decline of close to 10% week/week in heating degree days, correlating with a 3.3 Bcf/d drop in residential/commercial demand for the report period. Demand from the power sector fell an estimated 1.2 Bcf/d week/week, partly a result of a 15% increase in wind generation, according to the firm.

“Exports to Mexico also began their seasonal holiday decline, decreasing by 0.6 Bcf/d week/week, and are unlikely to recover until mid-January,” Energy Aspects said.

EIA reported an 88 Bcf withdrawal from inventories for the week ended Dec. 10. That left total working gas in storage at 3,417 Bcf, which was 326 Bcf below year-earlier levels and 64 Bcf below the five-year average.

Cash Climbs

Spot gas prices forged higher on Tuesday, fueled by strong demand in the Northeast.

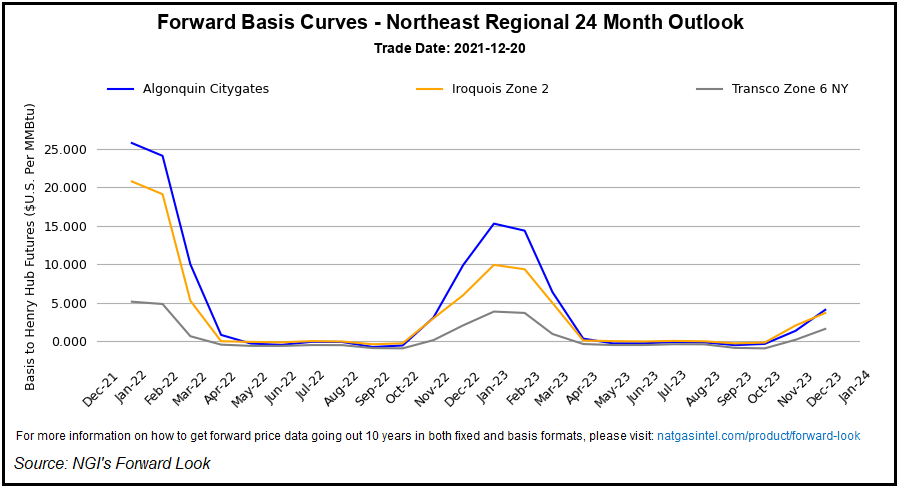

Algonquin Citygate near Boston advanced $2.465 day/day to average $10.125. Elsewhere in the region, Iroquois Zone 2 jumped $2.980 to $7.630 and Tenn Zone 6 200L gained $1.690 to $10.010.

However, NatGasWeather said that, at the national level, demand proved modest Tuesday. That was expected to remain the case for several more days “as high pressure strengthens over most of the central, southern and eastern U.S., with highs of 50s to 70s.”

NatgasWeather noted colder exceptions coming this week across the Northwest and northern Plains, “as chilly weather systems bring rain, snow and frosty lows” to the far northern reaches of the central United States.

The overall warmer setup, though, could “soften the spot market” and, by extension, “restrain the front month in the near term,” EBW’s Rubin said.

“By next week, however, building cold will likely increase demand for natural gas as the January contract approaches final settlement,” he added.